Acquisition project | Gensol Group

Hi there, we'll take this one step at a time!

If you struggle with a blank canvas, use this boilerplate to start. Remember, this is a flexible resource—tweak it as needed. Some sections might not apply to your product and you might come up with great ideas not listed here, don't let be restricted.

This is not the only format, we would love to see you scope out a great format for your product!

Go wild and dive deep—we love well-researched documents that cover all bases with depth and understanding.

Do you face problems with moving your goods from one point to another? Wayo App allows you to transfer goods from one place to another in a cheap, reliable and hassle-free way! With over 6000+ monthly active customers and 10000+ verified drivers, your delivery isn't just a single transaction, but a commitment for us! Unlike the usual practice, where there is a regular haggling with drivers for getting the right price and lack of transparency of movement of goods, we give you complete control. Join us on our mission as we help moving billions of dreams one delivery at a time. Download the Wayo app from the appstore (Andriod and iOS) and book your order now!

Deconstructing the elevator pitch:

"Do you face problems with moving your goods from one point to another?” | Hook (A point that grabs attention addressing a common desire) |

" Wayo App allows you to transfer goods from one place to another in a cheap, reliable and hassle-free way!” | Value (The core value that highlights your product) |

"With over 6000+ monthly active customers and 10000+ verified drivers, your delivery isn't just a single transaction, but a commitment for us! ” | Evidence (statistics, impressive numbers, proof to highlight the hook) |

"Unlike the usual practice, where there is a regular haggling with drivers for getting the right price and lack of transparency of movement of goods, we give you complete control.” | Differentiator (aspects that differentiate your product from its competitors) |

"Join us on our mission as we help moving billions of dreams one delivery at a time. Download the Wayo app from the appstore (Andriod and iOS) and book your order now!" | Call to Action (what are the next steps after listening to the pitch) |

What is the specific problem we are solving?

We are trying to solve for three things primarily:

- Safe transfer of goods between the city

- Wide assortment of vehicles to transfer your goods

- Vehicle availability

(Go and speak to different users of the product and the people in the chain: households buying the product, shopkeepers selling the product, churned users, and users using competitor's products. In the case of B2B products identify the decision makers, the influencer, the blocker, and the end-user)

Understanding your ICP:

Step-1: Building the ICP

Criteria | ICP 1 | ICP 2 | ICP 3 |

Name | Mr. Ankit Dwivedi | Mrs. Shalini Choudhary | Mr. Devansh Agrawal |

Age | 40 years | 25 years | 28 years |

Demographics | Gender: Male; Level of education: Graduation; Employment: Self employed; Marital Status: Married | Gender: Female; Level of education: Post-Graduation; Employment: Self employed; Marital Status: Unmarried | Gender: Male; Level of education: Post-Graduation; Employment: Working in an MNC; Marital Status: Unmarried |

Need | Transport goods from one point to another in the following way: | Transport goods from one point to another in the following way: | Transport goods from one point to another in the following way: |

Company Size |

|

| NA |

Industry Domain and nature of business |

|

| NA |

Pain Point | * Variable and high pricing, which creates issues in his costing estimation | * Lack of trusted delivery platforms - had a bad experience with Porter as the final product needs to reach the final customer in a specified manner | * Wants to shift his household goods from one point to another - but not able to find trustworthy vendors |

Solution | For Point-to-point deliveries, he uses On-Demand platforms like Porter For customizable deliveries, he still uses the Naka | For Point-to-point deliveries, she uses On-Demand platforms like Porter Uses cab services (Ola/Uber) to send her stock sometimes | Uses Porter for smaller loads within the city For larger goods/intercity movement, uses packers and movers services like APML |

Decision Maker |

|

|

|

Marketing Pitch | Transport your goods anywhere in Delhi NCR in the cheapest, safe and hassle-free manner | Transport your goods anywhere in Delhi NCR in the safest possible manner! | House shifting made easy - Use our services to move your home in a safe and homely manner! |

Frequency of use case |

|

| Rarely requires it - 1-2 deliveries every 6 months |

Average Spend on the product | Rs. 3000-3500/day | Rs. 1000-1200/day | Rs. 2000/year |

Frequently used apps |

|

|

|

How did they get to know about the competition |

|

|

|

Price Sensitivity | Moderate to High | Moderate | Low |

Types of languages they consume |

|

|

|

Insights Drawn:

Need: multiple vehicle availability on one platform, safe movement of goods

Actionable:

Tailor made acquisition campaigns addressing the above needs. Sample content in the table below:

Need Addressed | Content |

|---|---|

Multiple Vehicle Availability | Send anything - from a document to a Bed! Only on the Wayo App |

Safety | With over 1,00,000+ deliveries done! Customers find us safe and trustworthy |

There is an element of price sensitivity: Can play on the pricing/discount

Can create an acquisition discount for these customers to improve upon adoption of the application

Whatsapp is the most preferred customer channel of communication

We can Whatsapp communication as the mode of communication, especially for referral. There is a higher chance of increasing referral/users

Step-2: ICP Prioritization

Criteria | Adoption Rate | Appetite to Pay | Frequency of Use Case | Distribution Potential | TAM ( users/currency) |

ICP 1 | Moderate | High | High | Moderate | Large |

ICP 2 | High | High | Moderate | High | Low |

ICP 3 | High | Moderate | Low | High | Low |

We have prioritized the ICP 1 and ICP 2, based on the above given metric

(Before you begin, you need to know what your product is, what are its features, what is the problem being solved by your product?)

Understanding Core Value Proposition

The Core Value Prop was understood using the following framework:

Step-1: Explore the product

The major features that the product has are as follows:

- Multiple vehicle categories, to drive conversion and Wallet Share of the customer

- Multiple order types - Point-to-point; Multiple stops

- Serviceable across the city - can select a pickup/drop across the city

- Offer rental packages, if you want to book a vehicle for a longer time frame (2 Hours; 4 Hours etc.)

- Can schedule a vehicle if you need instantaneously

Step-2: Analyze the feedback

The Google playstore ratings is 4.0 with the following split:

Most of the negative reviews are around:

- Bad support team experience: Most of the cases are around poor customer call center team - Response rate is low

- Vehicle availability challenge: Our service levels were not good initially. Most of the issue was right after the launch

Positive reviews are around:

- Pricing

- Vehicle availability becoming better

Looking at the above, the CVP is as follows:

For anyone (large company, SME or individual) who wishes to move goods from one point to another, Wayo is an On-Demand logistics platform that helps you do this in an affordable, reliable and hassle-free way

Factors | Local Naka | Porter |

|---|---|---|

What is the core problem being solved by them? |

|

|

What are the products/features/services being offered? |

|

|

Who are the users? |

|

|

GTM Strategy |

|

|

What channels do they use? |

|

|

What pricing model do they operate on? |

|

|

How have they raised funding? | NA | $ 150 Million till date |

What is your product’s Right to Win? |

|

|

What can you learn from them? |

|

|

Competitor Analysis:

The competitor analysis was done above. The major player in the Intracity space is Porter. Here are some additional points that we try to look at to understand how they are faring:

- Pricing: We are about 7-10% cheaper in all distance buckets as compared to Porter. This is to drive repeat usage and demand

- Current Take Rate: Porter charges a flat commission on every order complete. The current take rate for Porter in about 14-15%, which contributes to it's Gross Margin (GM). We are not taking anything as of now from the driver as we want to build supply and ensure that the earnings of the driver reaches a certain level

- Orders: Porter currently is doing about 3.5 Lakh orders/day from the top-6 cities (contributing to 80% of the total Pan-India trips)

- Revenue: The revenue would be around Rs. 16 Crore/day

Market Sizing:

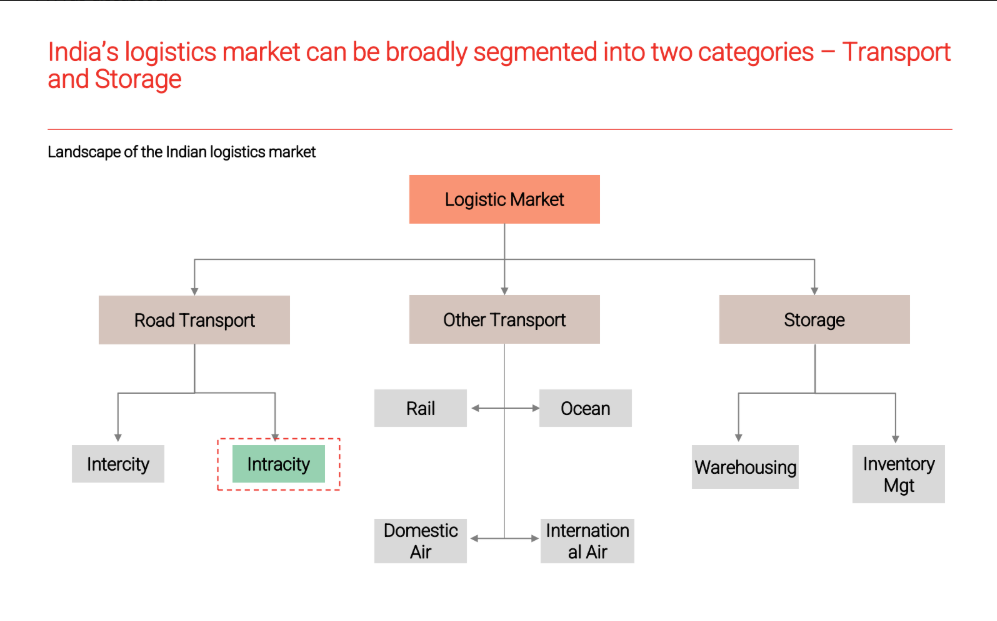

The logistics market can be divided into the above. Majority of the share is concentrated in the Road Transport (~65%)

Intracity contributes to about 14% of the total road transport market size. Of this, ~60% is contributed by the top 50 cities. For intracity logistics, the population of the city plays a major role, with major consumption happening there. Consumption drives stock movement

Top-20 cities contribute to around $20 Billion, with the top about $14 Billion coming from the top-6 cities. Hence, looking at the above definitions:

Total Addressable Market - Pan India

This would be the total intracity market across India. As per the research, this would be about $34 Billion

Serviceable Addressable Market - Top 6 cities

Given the current scope and profitability also, we will be targeting the top-6 metro cities only. These contribute to about $14 Billion, which is SOM

Serviceable Obtainable Market

Currently, we are operational in just 2 cities i.e. Delhi NCR and Bangalore. Our current revenue from both the cities is about Rs. 1 Cr. That amounts to about less than 0.001% of the market share

Designing Acquisition Channel

(keep in mind the stage of your company before choosing your channels for acquisition.)

The current company is in the stage of early scaling. As mentioned in the project brief, I will focus on one channel partner and one paid channel

The framework of choosing the acquisition channel depends upon the stage of the city:

The channels chosen are acquisition depends upon the stage of the cities we are functional in. The details are as below:

City-1: Delhi NCR

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | High | High | Moderate | Moderate |

Paid Ads | Moderate | High | Low | High | High |

Offline Marketing | High | Low | High | Moderate | Low |

Referral Program | Moderate | High | Moderate | Moderate | Moderate |

Field Sales Team | High | Moderate | High | Low | Low |

We have been operational in Delhi NCR for about 8 months now. We have expanded our services to about the entire city, with about 5 vehicle categories being operational. Here, the major channels that we are focusing on are:

- Paid Ads: This will help us now to grow at a faster clip, thereby aiding us in acquisition

- Referral Program: Currently, about 70% of the customers get acquired through the BD Channel. Out of the rest 30%, about 20% come through the referral channel. This includes D2C (Driver-to-customer) and C2C (Customer-to-customer) referral. We have made a clear construct around this to drive adoption

- Field Sales Team: As of now, there are still many zones within the city that require us to be physically do a sweep. This helps in faster adoption of customers, meanwhile providing us with a critical mass of customers on which the Digital and other channels can work on. Hence, the leads are fed into the CRM and the much needed fly-wheel needs to start

This is being bolstered by the Offline marketing (vehicle branding, auto rickshaw branding) to drive awareness and brand recall

City-2: Bangalore

Bangalore just got launched about 2 months back. The major acquisition channels are as follows:

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | High | High | Moderate | Moderate |

Paid Ads | Moderate | High | Low | High | High |

Offline Marketing | High | Low | High | Moderate | Low |

Referral Program | Moderate | High | Moderate | Moderate | Moderate |

Field Sales Team | High | Moderate | High | Low | Low |

We are currently operational in about 50% of Bangalore, with about 3 vehicle categories (2W is yet to be launched). Currently, there is a very small base of customers on which critical mass can be built. The major channels (as highlighted) are as follows:

- Field Sales Team: Although it is not a feasible option later, this helps in building a base of customers who are very similar to the ICPs. They help in a targeted approach and also help in pointing out any issues the customers are facing, to close the loop faster

- Offline Marketing: Offline marketing working in tandem with the field sales team to help drive top-of-mind recall and awareness

Organic Channel

(Understand the existing organic channel strategy for your product and highlight the success and failure thereon.

Provide your suggestions and devise new strategies.)

Step 1 → Conduct keyword research on Google, Amazon, Youtube, Quora etc.

Step 2 → Collate all your insights from all your searches.

Content Loop

Step 1 → Nail down your content creator, content distributor and your channel of distribution

Step 2 → Decide which type of loop you want to build out.

Step 3 → Create a simple flow diagram to represent the content loop.

Step-1: Understand your audience

Through user research interviews, the answers to the following questions is found out:

Where do users spend time - their habits and preferences?

ICP 1 | ICP 2 | |

|---|---|---|

Frequently used apps |

|

|

Online Habits and preferences |

|

|

Step-2: Finding the right type of loop

Customer profile | Hook | Content Creator | Distribution Channel |

|---|---|---|---|

ICP 1 and ICP 2 | Transport your goods safely with trusted drivers from one point to another | The Brand | For the first few cycles: |

ICP 1 and ICP 2 | We have a wide assortment of delivery options: 2W to Pickup/8ft | The Brand | For the first few cycles: |

Why choose Youtube/Facebook as the platform:

- Most of the ICPs spend time on Youtube (as per the table above)

- The content type is video and audio based; that has better chances to grab more eyeballs

- Pin-point targeting: Helps in targeting very accurate user sets, which will help in decreasing our CAC

Step-3: Creating a flow diagram

The flow diagram has the content loop which is leading to the referral loop

(Understand what is already being done, what is working out well and what needs to be stopped)

Step 1 → Define the CAC: LTV ratio. If your product has a healthy CAC:LTV ratio, proceed with paid ads.

Step 2 → Choose an ICP

Step 3 → Select advertising channels

Step 4 → Write a Marketing Pitch

Step 5 → Customize your message for different customer segments to ensure relevance

Step 6 → Design at least two ad creatives (e.g., images, sketches, videos, text ads) that reflect your marketing pitch.

Step-1: CAC to LTV Ratio

CAC: Rs. 500

LTV: Rs. 3500

CAC: LTV - 1:7

Step-2: Choosing an ICP

We have chosen the ICP1 as mentioned in the previous sections. This is because of the following reasons:

- Higher Adoption Rate

- Higher appetite to pay

- Frequency of use case is higher

- Distribution potential is higher

- Bigger TAM

Pasting the ICP table again here, for your reference:

Criteria | ICP 1 | ICP 2 | ICP 3 |

Name | Mr. Ankit Dwivedi | Mrs. Shalini Choudhary | Mr. Devansh Agrawal |

Age | 40 years | 25 years | 28 years |

Demographics | Gender: Male; Level of education: Graduation; Employment: Self employed; Marital Status: Married | Gender: Female; Level of education: Post-Graduation; Employment: Self employed; Marital Status: Unmarried | Gender: Male; Level of education: Post-Graduation; Employment: Working in an MNC; Marital Status: Unmarried |

Need | Transport goods from one point to another in the following way: | Transport goods from one point to another in the following way: | Transport goods from one point to another in the following way: |

Company Size |

|

| NA |

Industry Domain and nature of business |

|

| NA |

Pain Point | * Variable and high pricing, which creates issues in his costing estimation | * Lack of trusted delivery platforms - had a bad experience with Porter as the final product needs to reach the final customer in a specified manner | * Wants to shift his household goods from one point to another - but not able to find trustworthy vendors |

Solution | For Point-to-point deliveries, he uses On-Demand platforms like Porter For customizable deliveries, he still uses the Naka | For Point-to-point deliveries, she uses On-Demand platforms like Porter Uses cab services (Ola/Uber) to send her stock sometimes | Uses Porter for smaller loads within the city For larger goods/intercity movement, uses packers and movers services like APML |

Decision Maker |

|

|

|

Marketing Pitch | Transport your goods anywhere in Delhi NCR in the cheapest, safe and hassle-free manner | Transport your goods anywhere in Delhi NCR in the safest possible manner! | House shifting made easy - Use our services to move your home in a safe and homely manner! |

Frequency of use case |

|

| Rarely requires it - 1-2 deliveries every 6 months |

Average Spend on the product | Rs. 3000-3500/day | Rs. 1000-1200/day | Rs. 2000/year |

Frequently used apps |

|

|

|

How did they get to know about the competition |

|

|

|

Price Sensitivity | Moderate to High | Moderate | Low |

Types of languages they consume |

|

|

|

We focused on the ICP1 for starters, from the ICP Prioritization framework

Step-3: Select advertising channels

The selected ICP spends most of the time on the following platforms:

- Youtube

- Google Search - for existing suppliers - Indiamart is frequently used

Most of the time spent on Apps is as follows:

- PayTM

- Truecaller is also an application used frequently

- Indiamart is used frequently

From the above, we would give preference to Google Search and Youtube as the channel. The other details regarding the ad campaign are as follows:

Step-4: Align with product market fit

Focus on the Delhi NCR first as that is the city with the highest market fit and highest number of orders. Also, this is the city that has the maximum amount of critical mass of customers to drive the organic channel

Step-5: Define your creative strategy

Below is the content strategy for the major ICP we are targeting right now:

ICP 1

Marketing Pitch-1:

Apna samaan safely bhejein Delhi NCR mein kahin bhi! 20,000+ customers ka bharosa hai hum par!

Justification:

- Addressing the core need of the ICP - and that in turn is the core value prop of the product. The biggest need is safety of the goods and since this is a new company, there is little trust in the company

- Making the communication in Hinglish as the ICP is not that fluent in English and prefers Hindi as the preferred medium

- Added a trust factor, like 20,000+ customers transacted with us till now

- Ad Objective here is App promotion. Once the user clicks, he will be redirected to the app/playstore page

Budget Allocation:

Target CAC = 300

Number of data points required = 300 (As a rule of thumb)

Budget for the campaign = Rs. 90000

Right Ad-format:

We would be going forward with Display and Search ads. A combination of both is good because there are many use cases where the customer is searching for a mini-truck and we want to be right up there in the search. Also, we being a new brand, it is imperative for us to be out there

Marketing Pitch-2:

Bed se document ki delivery, kijiye humaare saath! Aaj hi Wayo par aayein aur apni delivery book karein aur paayein aakarshak discounts!

Justification:

- Addressing another core need of the ICP - and that in turn is the core value prop of the product. He has the option of multiple delivery types on his platform

- Making the communication in Hinglish as the ICP is not that fluent in English and prefers Hindi as the preferred medium

- Added a discount CTA, for better conversion

- Ad Objective here is App promotion. Once the user clicks, he will be redirected to the app/playstore page

Budget Allocation:

Target CAC = 500 (Assumed a higher CAC here, because this is a relatively lower need for the customer)

Number of data points required = 300 (As a rule of thumb)

Budget for the campaign = Rs. 150000

Right Ad-format:

We would be going forward with Display and Search ads. A combination of both is good because there are many use cases where the customer is searching for a mini-truck and we want to be right up there in the search. Also, we being a new brand, it is imperative for us to be out there

Sample Ad Creatives:

Below are the steps we are using for deciding the necessary product integrations:

Step-1: Define and Identify the ICP

As per the ICP prioritization framework, we are trying to optimize for the ICP 1 and ICP 2

Step-2: Identify complementary products used by your ICP

Upon conducting user calls the following information was gathered:

ICP 1 | ICP 2 | |

|---|---|---|

Frequently used apps |

|

|

The ones marked in green are common to both the ICPs and should be a good starting point to further narrow down the products we can choose

Step-3: Use the selection framework

Channel Name | How frequently do they interact with the products? | How important are those interactions? | Can your product add value to those interactions? | How many new users/use cases can you get? |

Paytm | Daily | Important | Unsure - confidence level is low | Not many |

Daily | Important | No | Not Many | |

Daily | Can vary - generally not so important | No | Not Many | |

Amazon | 1-2 times a week | Important | No | Not Many |

Truecaller | Daily | Unsure | No | Not Many |

Indiamart | 1-2 times a week | Important | Yes | Relevant users - similar to the ICP profiles can be targeted |

Google Maps | Daily | Important | Unsure - in some cases yes | Not Many |

From the above, couple of product integrations seem logical:

- Indiamart - App and Web

- Google Maps

Step-4: Collaborate with the necessary stakeholders

Relevant Stakeholders | Company | Details |

|---|---|---|

Product team |

|

|

Business team (Growth team) |

|

|

Legal Team |

|

|

Engineering Team |

|

|

Step-5: Map customer journey and design wireframe with new integration

Details are as per the document attached:

It covers the following:

- Current flow

- Where the product integration makes sense?

- Proposed flow

Product Integration.pdf

Step-6: Measure post integration metrics

Some of the post integration metrics are as follows:

Note: All these metrics are from the Indiamart channel

Which metric? | Why? |

|---|---|

App Downloads |

|

# of first orders placed |

|

# of customers placing their first order |

|

CAC (from the Indiamart channel) |

|

# of leads generated |

|

Below is the framework I have used to develop the referral programs:

Step 1: Identify customer touchpoints

The AHA moments for the customers are as follows:

- Price discovery for all the vehicle categories

- All the extra coupons that are active on the current order

- Vehicle gets allocated (say within X seconds)

- Driver comes to pick up the order

- Track-ability of the goods (customer is able to see where his goods are in real-time)

- Driver drops off the goods without any escalation

This one marked in red is the where we should build the referral

Step 2: Define the Brag-Worthy Element

Customers, being SMEs, want to book repeat orders. Hence, for us it would be discount on the subsequent trips

Step 3: Define Your Platform Currency

The platform currency here would be discounts/cash-backs. Also, we can build it in the allocation algorithm, like more referrals helps you bring better drivers >> improving customer experience >> repeat orders

Step 4: Determine Who to Ask for a Referral

We would break it into two main buckets:

Bucket 1: Heavy/power users

These would be the group that have completed >=3 orders in a month anytime since their LTV They are using the application the most. hence are our biggest brand ambassadors

Location: This should be right before the new order placement page, as for them it is something they would be keen about

Bucket 2: Anyone placing 5 orders in their lifetime, irrespective of their >=3 orders in a month:

These are customers who have sporadic requirements, but nonetheless they would be able to place an order

Location: For these users, it can right at the end, not to break the product flow

Step 5: Referral/Partner Discovery

Majorly, if we look at our ICP 1. they use Whatsapp heavily for their day to day communication. We can use Whatsapp as a channel. Major other channels are:

- Push Notifications

- In-app features: Banners, pop-ups

- In-app notifications

- Videos on the Youtube Channel - how to refer? Testimonial videos from existing users etc.

For starters, we can do a calling once (not scalable, but one time) to increase the adoption

Sample screens:

Comments:

- There is a big CTA under the pickup/drop which will help to grab the attention of the user

- Also, there is a "Refer and get discounts" tab under the profile section of the user

- Upon clicking on either, a bottom sheet will open, which will ask the user to "Refer Now". The customer can then click and will be redirected to the referral page

6. Referral Sharing & Communication

Most of the communication between the users of similar ICP is on Whatsapp. Hence, we should have Whatsapp channel to share the referral link

Referral message can say something like:

Hi. Mr. X (to build credibility) has referred you for 50% off on your first five trips on Wayo. Find it waiting for you here!

Sample Screens:

Although the user has the option to choose the mode of communication

7. Tracking Referrals

In this section, we have tried to look at the following things:

What will the referral tracking page look like? How will referees know if their referrals were successful?

The above two questions have been tried to be addressed here:

We have three separate tabs here:

- Invited: Contacts who have been invited for the referral

- Installed: Contacts who have installed the app but haven't placed the order yet - We have an option of reminding the installed contacts to place an order. We can remind the customer in the following ways:

Here, we are integrating Whatsapp for this, as this is most preferred channel for the ICP

- Successful: The contacts who have successfully placed a single order

8. Design the Referral Landing Page for Non-users

A non-user first sees the referral message sent via any channel. He clicks the link and is redirected to the play store/app store page. The app store/play store page picks it up from there

9. Ensuring Continuous Referrals

We have tried to do the following rewards for the users who are regularly referring:

- Incremental tired rewards for continuous referring: With a clear visibility of the customers who have referred, we plan to create a streak feature. The streak is as follows:

We ensured the following:

- The rewards are a big enough incentive to continuous refer: the discount construct is defined as such

- Number of free trips are tiered at an increasing number

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.